Now Accepting Form 2290 for the 2023-2024 Tax Period. File Now and Get your Stamped Schedule 1 in Minutes. E-file Form 2290 Now

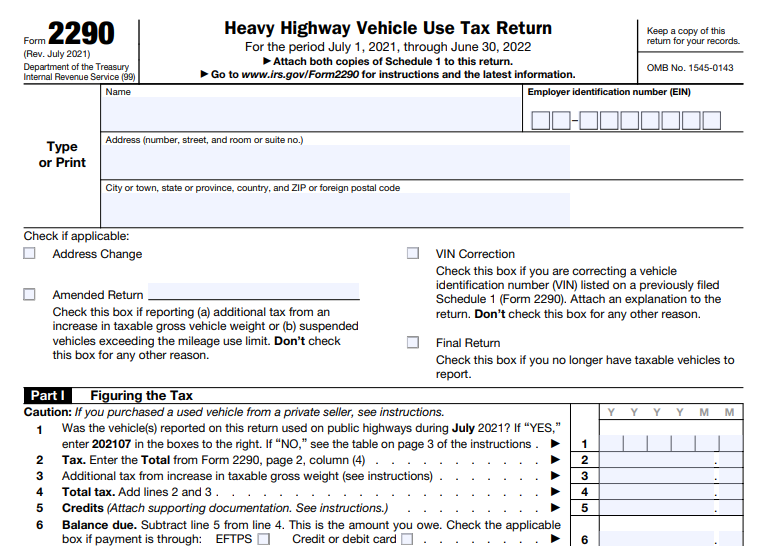

HVUT Form 2290 Overview

Form 2290 is a Heavy Vehicle Use Tax Return filed with the IRS on an annual basis. This return is filed to calculate and pay the Heavy Vehicle Use Tax (HVUT) for every tax year. Any vehicle with a taxable gross weight of 55,000 lbs or more will be considered a heavy vehicle and must file Form 2290.

Download the IRS Printable Form 2290 in 3 Simple Steps

Just follow the simple steps to download your

printable Form 2290.

- Step 1: Enter the Business and Vehicle Information

- Step 2:Review and Transmit directly to IRS

- Step 3:Download or Print your 2290

It takes less than 5 minutes to create and download the

Form 2290.

Information required to file Form 2290

EIN, Business Name

& Address

VIN of Taxable Vehicles and its Gross

Taxable Weight

Signatory details

If you are going to pay the IRS via direct debit, ensure that your routing and account number ready.

Who is Required to File 2290?

- If the vehicle is registered on your name at the time of its first use during the period and the vehicle has a taxable gross weight of 55,000 pounds or more and it is expected to exceed the mileage above 5000 miles (7500 miles for Agricultural & Logging vehicles), you are required to pay the HVUT to IRS and report the same through Form 2290.

- If you are planning to operate the vehicle less than 5000 miles (7500 miles for Agricultural & Logging vehicles) in the tax period, you can file the vehicle as Tax-Suspended vehicle and no taxes have to be paid. However, IRS mandates you to file Form 2290 as the Tax-Suspended vehicle.

- If your vehicle is demolished, stolen, sold, or used 5,000 miles or less (7,500 miles or less for agricultural vehicles) then you can claim a credit for tax paid and report the same through Form 2290.

- Report acquisition of a used taxable vehicle for which the tax has been suspended. Calculate and pay the tax due on a used taxable vehicle acquired and used

during the period.

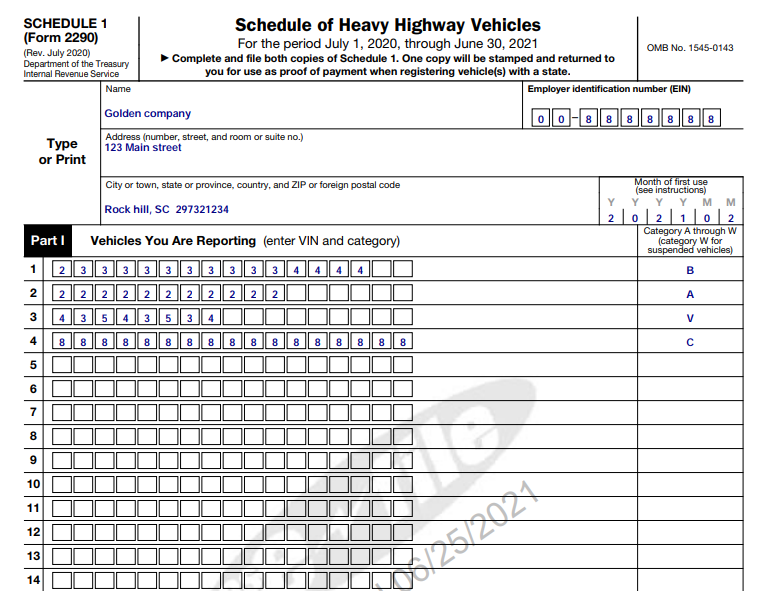

Schedule 1 (Form 2290), A Proof of Payment for HVUT

- Bureau of Motor Vehicles (BMV) requires the proof of payment of HVUT each year and it can be achieved through Schedule 1.

- If you are operating the truck, you need to keep the Stamped 2290 Schedule 1 on your vehicle always for the respective year and it is required for tags and vehicle registration at the Department of Motor Vehicle (DMV).

Visit https://www.expressefile.com/e-file-form-2290-and-get-schedule-1-online/ to know more about Schedule 1.

When Form 2290 filing is due?

Form 2290 must file annually for each taxable vehicle that is used on public highways during the current tax period. The current tax period begins on July 1, 2023 & ends on June 30, 2024. The due date to file 2290 is on August 31st, 2023.

Please find the following table for the due date:

| Vehicles first used month | Due Date |

|---|---|

| July 2023 | August 31, 2023 |

| August 2023 | September 30, 2023 |

| September 2023 | October 31, 2023 |

| October 2023 | November 30, 2023 |

| November 2023 | January 3, 2024 |

| December 2023 | January 31, 2024 |

| February, 2024 | March 31, 2024 |

| March, 2024 | May 01, 2024 |

| April, 2024 | May 31, 2024 |

| May, 2024 | June 30, 2024 |

| June, 2024 | July 31, 2024 |

| January, 2024 | February 28, 2024 |

* First used month is mandated by IRS for the all the vehicles reporting Form 2290 and it has to be chosen under “line 1”.

If due date falls on a Saturday, Sunday or legal holiday, file Form 2290 and pay HVUT by the next business day.

Why Form2290printable.com?

A quick and simple solution to create, fill, download & print Form 2290. Generate unlimited 2290 forms and organize all your Forms under a single account.

Effective Form 2290 E-Filing Solution

Enhance your 2290 Reporting by filing 2290 online & get your Stamped Schedule 1 in minutes.

- Avoid waiting in long queue in IRS & Post Office

- Avoid bunch of Paper works

- Avoid late filing penalties

Pay only $14.90 for a single vehicle to e-file your Form 2290. You will receive the Stamped Schedule 1 instantly.

Get the notification instantly about your Form 2290 filing status. And in case, if your return gets rejected, you can correct &

retransmit it for free.

Helpful Resources for Form 2290

Penalties for Not Filing Form 2290

The IRS may impose a penalty for the late filing of Form 2290 and late payment of HVUT.

If you miss filing your IRS Form 2290 within the deadline, the IRS will impose a penalty equal to 4.5% of the total tax amount due. Also, the penalty will increase every month for up to five months.

If you miss making the HVUT payment, you’ll be charged with a penalty of 0.5% of the total tax amount due as a penalty, and there will be an additional interest of 0.54% each month.

Visit https://www.expressefile.com/2290-late-filing-penalty/ to know more about the

Form 2290 penalties.

CONTACT US

If you have any queries contact our support team through email support@expressefile.com at any time.